Banking M&A trends slow: What you should know

Banking M&A trends slow due to economic uncertainty, regulatory challenges, and technological disruptions, shaping future opportunities and strategies within the financial sector.

Banking M&A trends slow, raising questions about the future of the sector. What’s causing this slowdown, and how does it affect stakeholders? Let’s dive into the important aspects and implications.

Understanding the current landscape of banking M&A

Understanding the current landscape of banking M&A is essential for industry participants and observers alike. As the market evolves, there are significant shifts and trends that impact mergers and acquisitions in the sector.

Key Elements of the Landscape

Several factors play a role in shaping the banking M&A environment. The following elements are crucial:

- Market conditions: Fluctuations in the financial market can affect M&A activity.

- Technological innovations: Advancements in technology are transforming how banks operate, which influences merger decisions.

- Regulatory changes: New regulations can either facilitate or hinder M&A opportunities.

- Economic factors: The overall economic climate impacts confidence, driving banks to consider potential mergers.

Banks must navigate these complexities to remain competitive. The landscape is not only influenced by internal strategies but also external pressures. One major trend is the rise of fintech companies, which challenge traditional banks. As fintechs grow, banks might seek mergers to enhance their technological capabilities.

In the current scenario, collaboration between banks and fintechs has become increasingly important. By merging with tech-savvy firms, banks can innovate and provide better services. This adaptation aims to attract younger customers who prefer digital banking solutions.

Emerging Trends

As we dive deeper into the landscape, it’s clear that some trends are emerging:

- Focus on customer experience: Banks are prioritizing customer satisfaction, driving M&A strategies to improve services.

- Green banking initiatives: Environmental sustainability is influencing mergers as banks pursue eco-friendly practices.

- Globalization of banking: International mergers are on the rise, connecting banks across borders.

Understanding these trends equips stakeholders with the knowledge to navigate the current landscape. It’s clear that flexibility and innovation are keys to thriving in this evolving market.

Key factors causing the slowdown in M&A activity

The slowdown in M&A activity in the banking sector can be attributed to several key factors. Understanding these factors is essential for stakeholders aiming to navigate this environment effectively.

Economic Uncertainty

One major reason for the slowdown is the increasing economic uncertainty. Factors such as inflation rates, unemployment levels, and global economic trends create a cautious market atmosphere. Banks may hesitate to engage in mergers or acquisitions when they are unsure of the economic outlook.

- Inflation concerns: Rising prices can limit consumer spending and impact profits.

- Interest rates: Fluctuating interest rates may affect financing costs.

- Global events: Geopolitical tensions can disrupt markets and bank strategies.

Navigating through these economic factors requires careful analysis and strategic planning. Banks are looking for ways to mitigate these risks while assessing potential opportunities.

Regulatory Challenges

Another significant factor affecting M&A activity is the evolving regulatory landscape. Compliance with new regulations often pushes banks to rethink their M&A strategies.

- Increased scrutiny: Regulatory bodies are more watchful over large mergers to prevent monopolies.

- Compliance costs: Adhering to regulations can be expensive and time-consuming.

- Changing laws: Variations in laws across regions complicate the M&A process.

These regulatory challenges can slow down decision-making as banks weigh the pros and cons of potential deals. The need for extensive due diligence often delays the process further.

Technological Disruptions

Technological advancements also play a critical role in this context. Fintech companies are reshaping the traditional banking landscape. Banks must adapt their strategies to deal with emerging technologies.

- Digital transformation: Banks need to invest in technology, potentially diverting resources from M&A.

- Partnerships with fintechs: Collaborations may be favored over acquisitions.

- Innovation races: The race to innovate can create hesitance in pursuing M&A.

The pressure to remain competitive through innovation can lead banks to explore partnerships instead of mergers. This shift in focus can further contribute to a slowdown in traditional M&A activity.

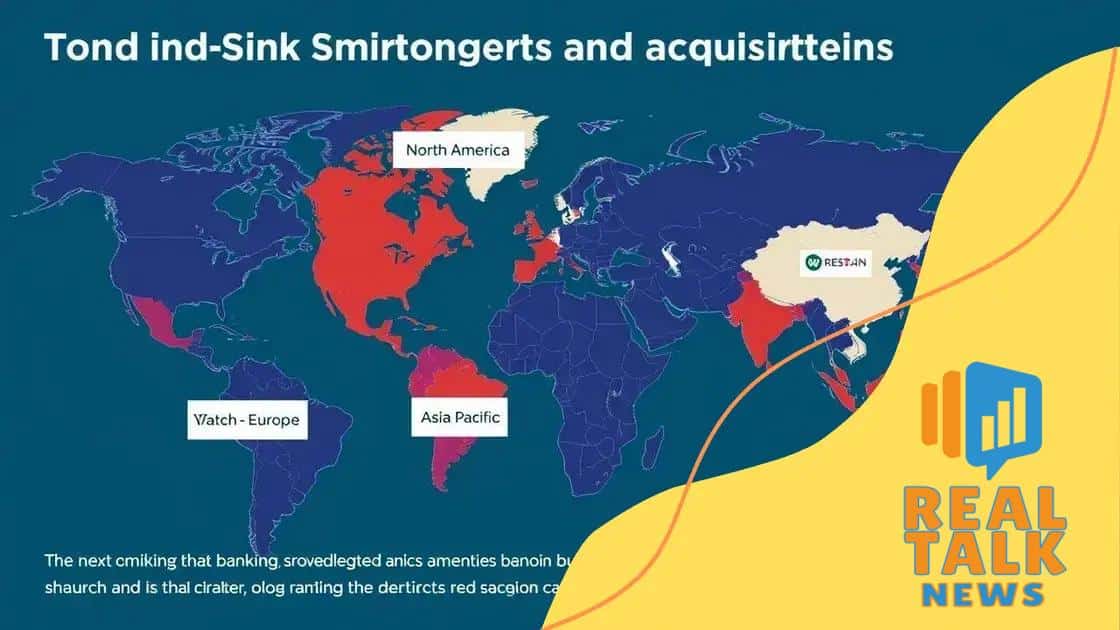

Regional variations in banking M&A trends

Regional variations in banking M&A trends highlight how different markets respond to economic forces. Understanding these differences can help stakeholders identify opportunities and risks associated with mergers and acquisitions.

North America

In North America, mergers and acquisitions are often driven by the competitive landscape. Banks frequently seek to expand their market presence and enhance operational efficiencies through strategic acquisitions.

- Market consolidation: Larger banks aim to consolidate smaller institutions.

- Technological investment: Many banks merge to combine resources for technology upgrades.

- Regulatory pressures: Regulations often encourage larger institutions to absorb smaller competitors.

The result is a complex landscape where larger banks dominate, and potential M&A activities can reshape the competitive field dramatically.

Europe

Moving to Europe, the situation differs significantly. The European banking landscape is often influenced by varying regulations and local market conditions. Here, cross-border M&A has gained traction as banks seek to leverage geographical advantages.

- Regulatory harmonization: Efforts to standardize regulations across the EU can facilitate M&A.

- Diverse consumer bases: Mergers can provide access to new markets and customer segments.

- Economic recovery: Post-pandemic recovery has encouraged banks to consider mergers for growth.

These factors enable banks to build stronger regional footholds, addressing both competitive and regulatory challenges through mergers.

Asia-Pacific

In the Asia-Pacific region, growth potential drives M&A activity. Rapid technological advancements and emerging markets present unique opportunities for banks.

- Fintech integration: Many banks merge with fintech firms to enhance digital offerings.

- Market entry strategies: Merging can facilitate access to burgeoning markets.

- Government support: Some governments encourage mergers to solidify financial stability.

This vibrant environment encourages banks to adapt and innovate, setting the stage for dynamic M&A activity.

Latin America

In Latin America, despite challenges like economic instability, banking M&A trends indicate a push for consolidation. Many banks focus on building resilience against external shocks.

- Consolidation efforts: Mergers are viewed as a way to strengthen market positions.

- Investment opportunities: Foreign investment can spur local bank mergers.

- Response to crises: Economic downturns often drive banks to seek partnerships for survival.

Understanding these regional variations is crucial for banks to formulate strategies that align with local conditions, ultimately guiding their M&A decisions effectively.

Impact of regulations on M&A in the banking sector

The impact of regulations on M&A in the banking sector is significant. Regulatory frameworks can shape merger behavior, dictating how and when banks can consolidate.

Increased Scrutiny

Regulators are paying more attention to potential mergers. They focus on preventing monopolistic behaviors that could harm consumers. As a result, banks must navigate a complex approval process.

- Antitrust laws: These laws are designed to promote competition and prevent market dominance.

- Regulatory bodies: Institutions like the Federal Reserve evaluate proposed mergers.

- Consumer impact assessment: Regulators analyze how a merger will affect customers.

This heightened scrutiny can result in longer timelines for mergers to be approved. Banks must be prepared to provide detailed information and justification during the review process.

Compliance Costs

Compliance with regulatory requirements often leads to increased costs for banks. These expenses may impact their willingness to pursue mergers.

- Due diligence: Banks must conduct thorough investigations before merging.

- Legal fees: The cost of legal advice can accumulate quickly in regulatory reviews.

- Operational adjustments: Mergers may require changes in operations to meet regulatory standards.

As compliance becomes more costly, some banks may reconsider the benefits of merging, especially in uncertain economic times.

Strategic Partnerships

On the other hand, regulations can also open opportunities for strategic partnerships. Banks may find value in collaborating with fintech companies to meet regulatory requirements.

- Innovative solutions: Fintech partnerships can help banks adapt to regulatory changes.

- Resource pooling: Sharing resources may simplify compliance efforts.

- Market expansion: Collaborations can enhance service offerings and reach new markets.

By leveraging partnerships, banks can navigate regulatory hurdles more effectively while still pursuing growth opportunities.

Future outlook for banking M&A opportunities

The future outlook for banking M&A opportunities is shaped by various factors. As the financial landscape evolves, banks must adapt to the new environment to seize potential opportunities.

Technological Advancements

Technology continues to reshape the banking industry, creating numerous opportunities for mergers and acquisitions. Banks that embrace technology can enhance their service offerings and improve operational efficiency.

- Digital transformation: Merging with tech firms can accelerate innovation.

- Data analytics: Banks can use data to identify potential M&A candidates.

- Consumer preferences: Technology-driven banks attract younger customers.

As banks focus on digital strategies, collaborations with technology companies may become more common, allowing traditional banks to keep pace with the changing market.

Regulatory Environment

The regulatory environment will also influence future M&A activity. As regulations evolve, banks must navigate these changes carefully. However, favorable regulations could encourage growth.

- Supportive policies: Governments might introduce policies that facilitate M&A.

- Streamlined processes: More efficient approval processes can stimulate M&A activities.

- Incentives for consolidation: Incentives may encourage smaller banks to merge for stability.

Successful navigation of the regulatory landscape can open new pathways for banks, making it essential for them to stay informed on changes.

Globalization Trends

As globalization continues to advance, banks are looking beyond their domestic markets for opportunities. Expanding internationally can lead to greater market share.

- Cross-border deals: Merging with international banks can enhance competitiveness.

- Diverse markets: Global expansion allows access to new customer bases.

- Strategic alliances: Partnerships can ease entry into foreign markets.

Understanding global trends will allow banks to take advantage of opportunities that may arise through international mergers and acquisitions.

Focus on Sustainability

Lastly, the growing emphasis on sustainability is shaping the future of M&A in banking. Merging with environmentally conscious firms can bolster a bank’s reputation and meet consumer demands.

- Green initiatives: Mergers focused on sustainability can attract eco-minded customers.

- ESG compliance: Banks may seek partners that align with environmental, social, and governance goals.

- Long-term viability: Sustainable practices will help banks remain competitive.

As the industry prioritizes sustainability, opportunities will arise for banks to engage in M&A that promotes both growth and social responsibility.

FAQ – Frequently Asked Questions about Banking M&A Trends

What are the key factors driving M&A activity in banking?

Key factors include technological advancements, regulatory changes, globalization, and a focus on sustainability.

How does technology impact banking M&A?

Technology enhances operational efficiency and creates opportunities for banks to merge with tech companies to improve services.

Why are regulations important in banking M&A?

Regulations shape the approval process and dictate how banks can consolidate, which can either facilitate or hinder M&A activities.

What role does sustainability play in future M&A opportunities?

Sustainability is becoming essential, with banks looking to merge with environmentally conscious firms to meet consumer demands and enhance their reputation.